Receiving Your Refund: A Guide to Getting Your Payment from the Internal Revenue Service

Table of Contents

- IRS Starts Sending Stimulus Checks - Yours Might Take Months To Arrive

- Stimulus Check 2023: Is the IRS sending stimulus checks to seniors ...

- Stimulus check 2021: IRS sends 1.1M additional COVID payments

- Irs Stimulus 2024 Check - Rhoda Arielle

- New wave of ,400 stimulus checks and extra cash payments being sent ...

- COVID-19 Stimulus Checks: How to Return if the IRS Sent a Stimulus ...

- Stimulus check 2021: IRS sends 1.1M additional COVID payments

- 4TH STIMULUS CHECK : IRS SENDING LETTERS TO NON FILERS FOR 00 ...

- Stimulus checks: When you’ll get your money and why some will have to ...

- Third Stimulus Check: Why The IRS Might Still Owe You Money | Money

Understanding the Refund Process

How to Check the Status of Your Refund

Ways to Receive Your Refund

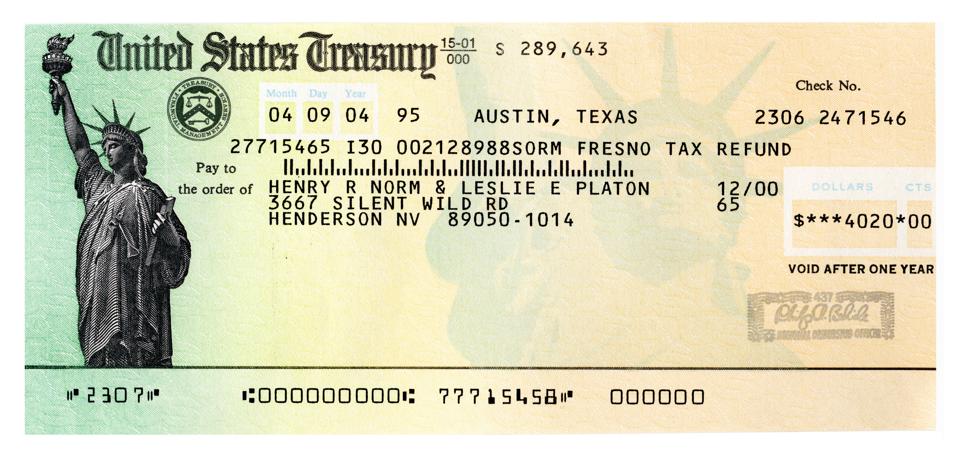

The IRS offers several options for receiving your refund, including: Direct Deposit: This is the fastest way to receive your refund, with most refunds being deposited within 8-14 days of filing. You can choose to have your refund deposited into one or multiple accounts, including checking, savings, or prepaid debit card accounts. Paper Check: If you do not have a bank account or prefer to receive a paper check, the IRS will mail your refund to the address listed on your tax return. This option can take several weeks to several months to arrive. Prepaid Debit Card: The IRS also offers a prepaid debit card option, which allows you to receive your refund on a debit card that can be used anywhere Visa is accepted.

Common Issues That May Delay Your Refund

There are several reasons why your refund may be delayed, including: Incorrect or Missing Information: Make sure your tax return is accurate and complete, including your Social Security number, address, and bank account information. Identity Theft: If the IRS suspects identity theft, your refund may be delayed while they verify your identity. Math Errors: Simple math errors can delay your refund, so double-check your calculations before submitting your tax return. Receiving your refund from the IRS can be a straightforward process if you follow the right steps. By understanding the refund process, checking the status of your refund, and choosing the right payment option, you can ensure a smooth and timely transaction. If you encounter any issues or have questions, don't hesitate to contact the IRS for assistance. Remember to stay patient and give the IRS time to process your refund, and you will receive your payment in due time.For more information on getting your payment from the IRS, visit the Internal Revenue Service website or call the IRS refund hotline at 1-800-829-1040.